A written contingency or succession plan is a necessary step in business ownership. Yet PwC’s 2021 U.S. Family Business Survey found that only 34% of family-owned companies had a documented and communicated succession plan. Your business could be in jeopardy without one.

Make emergency and long-term exit plans. An emergency plan typically accounts for events like an unexpected death or termination of employment. A long-term plan is a strategy you conduct over the years. It might involve bringing on new leadership, such as transitioning a child into the business so you can begin the retirement process. Or it might involve selling o parcels of the business or working toward a strategic vision.

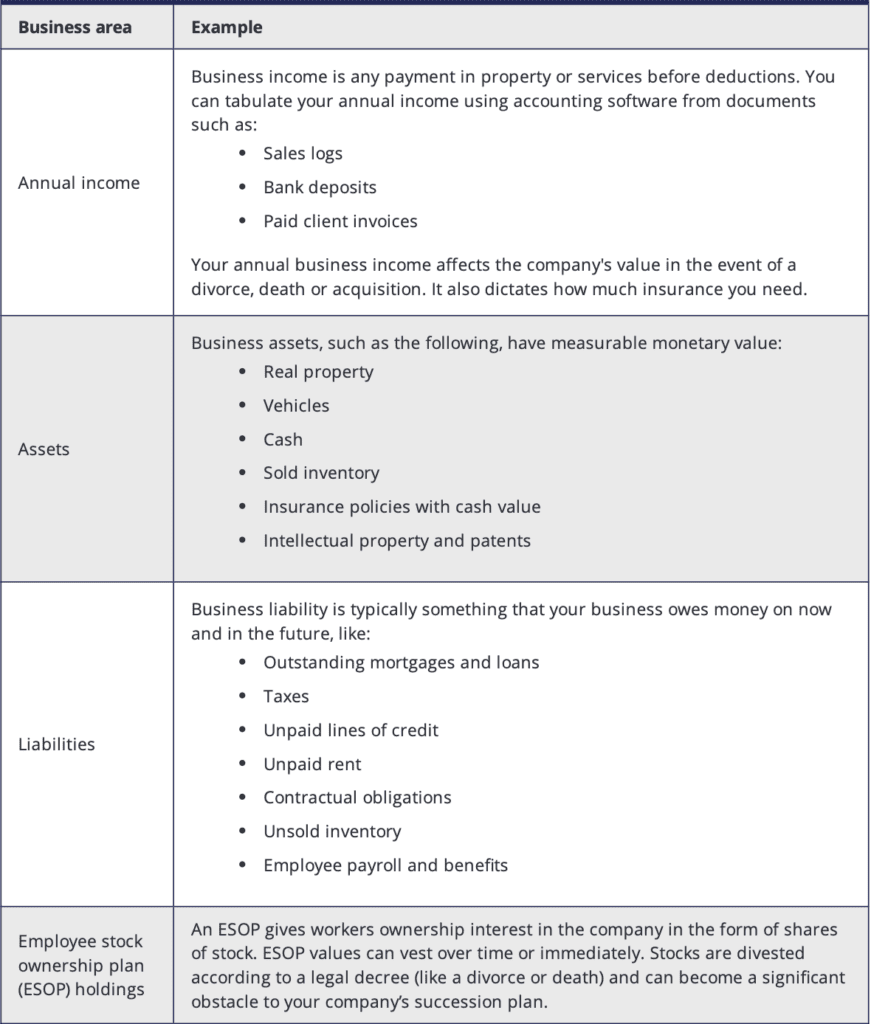

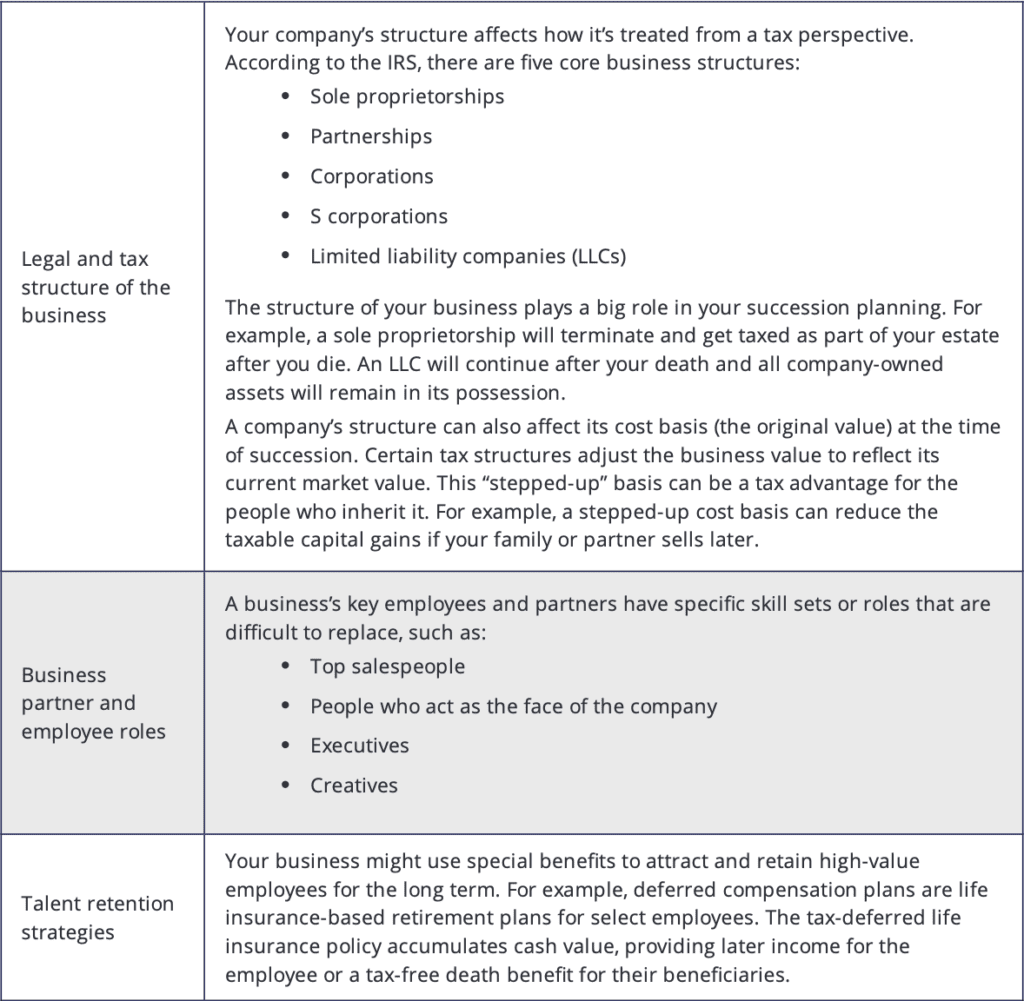

Succession plans require an accurate assessment of things like:

Planning for emergencies and expected transitions

Make a clear path for your business successors until they integrate into the company. If your long-term plan involves selling your business, a clear path to mitigating liabilities can make the sale of your business more attractive.

– Maintain accurate records of your business income, assets and liabilities. Annual income estimates are typically easier to track using software and accounting data. Assets like property might need occasional appraisals to keep abreast with market values.

– Update your succession plan as your business grows. Business expansion may require increased protection, especially when your liabilities change. This might include an inventory surplus or revenue dip as you gain a foothold in new territories.

– Organize select employee benefits like deferred compensation plans. Plans like these could keep high- value employees from leaving during a business leadership transition or sale, ensuring critical talent continues to feed your business.

– Track business liabilities and carve out a debt repayment strategy. For example, business loan insurance can provide a cushion against outstanding business loans after you die. Outstanding business loans might include property or mortgages, vehicles or eets, or unsold inventory.

– Review your emergency succession plan annually to ensure adequate funding of your coers. For example, you may need to buy out a partner’s shareholder interests due to a divorce or replace lost client revenue after a key employee quits.

Robust succession planning can help offset the loss of crucial revenue, employees, and clients, increasing your business’s chance of survival for future generations.

Start your succession plan

Kick off your business succession plan by consulting your power trio: your lawyer, accountant, and insurance agent. They can help you organize documents and advise you about the next steps to safeguard your legacy.